Introducing The Unshakeables, a new podcast from Chase for Business and iHeartMedia's Ruby Studio. Small businesses are the heart and soul of this country, but it takes a brave individual to start and run a company of their own. From mom-and-pop coffee shops to auto-detailing garages -- no matter the type of industry you’re in, every small business owner knows that the journey is full of the unexpected. A single moment may even change the course of your business forever. Those who stand firm ...

…

continue reading

Konten disediakan oleh Not Your Average Financial Podcast™. Semua konten podcast termasuk episode, grafik, dan deskripsi podcast diunggah dan disediakan langsung oleh Not Your Average Financial Podcast™ atau mitra platform podcast mereka. Jika Anda yakin seseorang menggunakan karya berhak cipta Anda tanpa izin, Anda dapat mengikuti proses yang diuraikan di sini https://id.player.fm/legal.

Player FM - Aplikasi Podcast

Offline dengan aplikasi Player FM !

Offline dengan aplikasi Player FM !

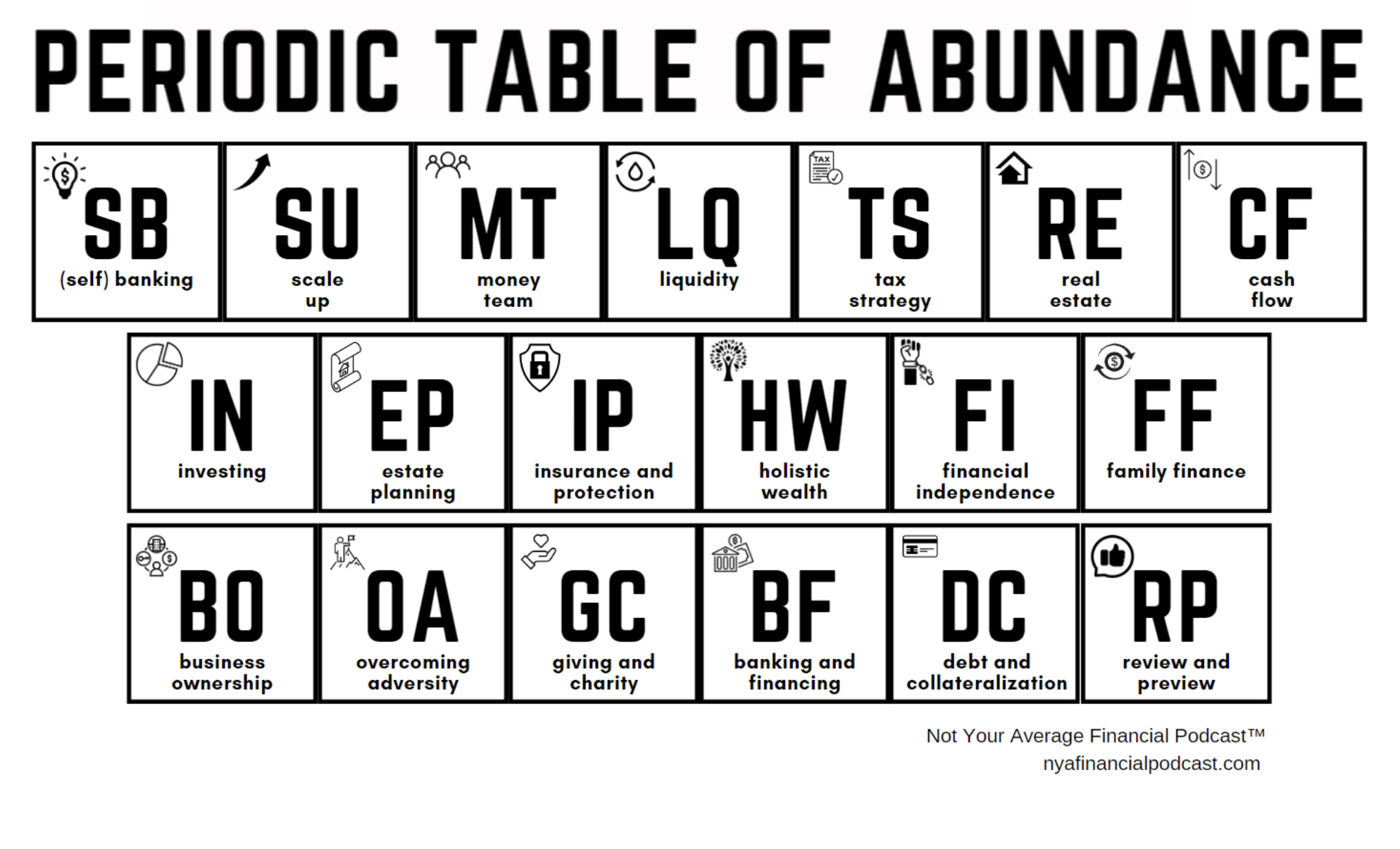

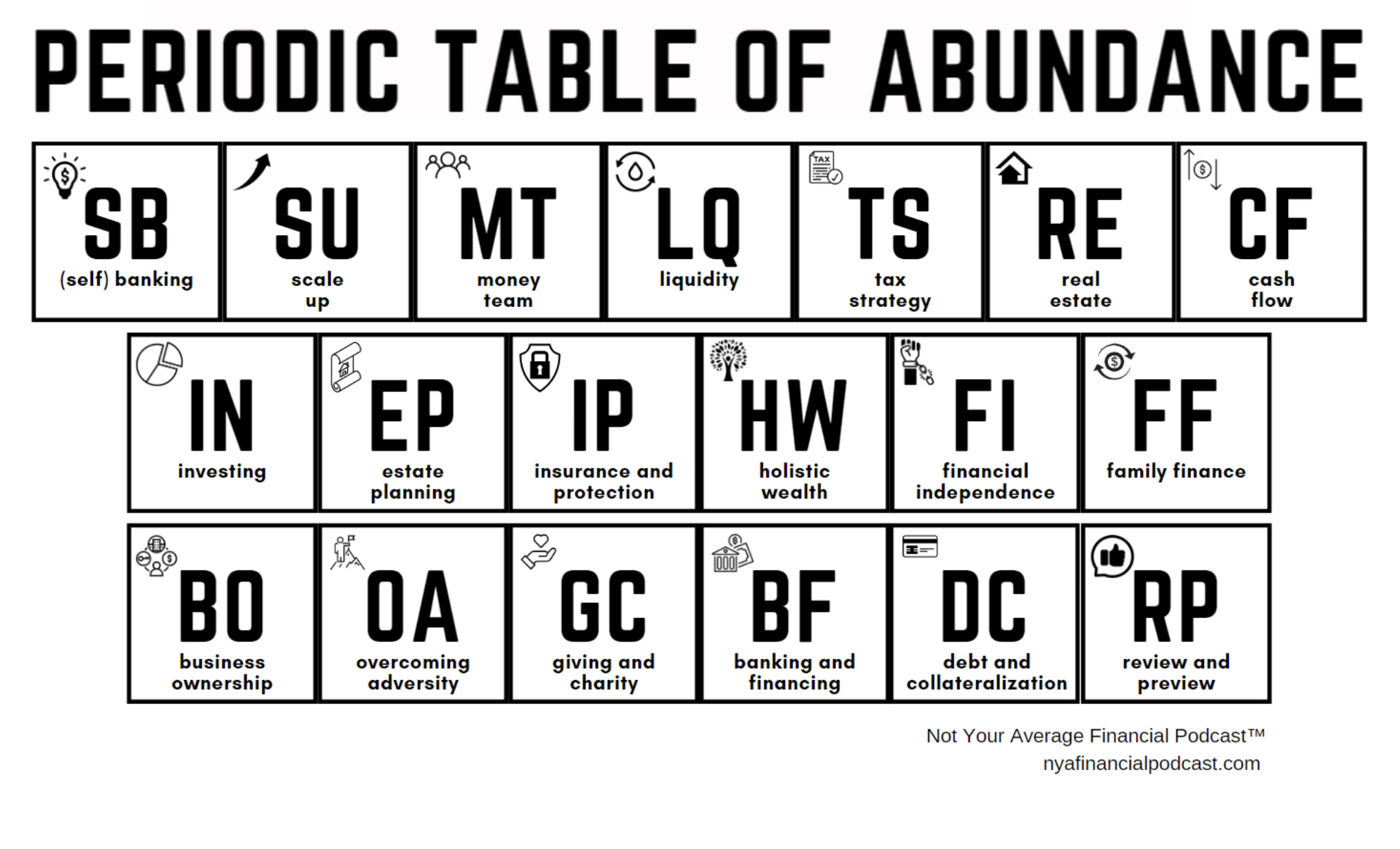

Episode 333: [The Periodic Table of Abundance] No.4 Secrets of Leverage Using Insurance and Banking

Manage episode 396232069 series 1610796

Konten disediakan oleh Not Your Average Financial Podcast™. Semua konten podcast termasuk episode, grafik, dan deskripsi podcast diunggah dan disediakan langsung oleh Not Your Average Financial Podcast™ atau mitra platform podcast mereka. Jika Anda yakin seseorang menggunakan karya berhak cipta Anda tanpa izin, Anda dapat mengikuti proses yang diuraikan di sini https://id.player.fm/legal.

In this episode, we ask:

- Can information alone change your financial future?

- Would you like to check out our FREE Not Your Average Financial Community?

- Have you listened to the previous episodes in this series?

- Would you like to hear Episode 330: No.1 Scaling Up and Overcoming Adversity?

- Would you like to hear Episode 331: No.2 Money Team, Family Finance and Estate Planning?

- Would you like to hear Episode 332: No.3 Liquidity and Cash Flow?

- What is the essential nature of insurance?

- What is the cost of insurance?

- What creates peace of mind?

- What is the purpose of all of this?

- What outcomes would you like?

- What about guarantees?

- What are the different types of insurance policies?

- What about health insurance?

- Who has medical bills?

- Why have health insurance?

- What about the alternative?

- What are the typical costs?

- What about being uninsured?

- What is the leading cause of bankruptcy in the U.S.?

- What is the health insurance marketplace?

- What about healthcare sharing ministries?

- Would you like to hear Episode 170?

- Would you like to hear Episode 224?

- What about property and casualty insurance?

- What is the average claim?

- What could protect you from financial ruin?

- What about auto insurance?

- What about umbrella insurance?

- What is coverage?

- What is a deductible?

- What about self insurance?

- What about life insurance?

- What happens upon death?

- How will your family afford the costs when you’re gone?

- What about cheap term insurance?

- What about group life plans through employers?

- What about getting insurance that meets your needs?

- What does banking have to do with life insurance?

- Who was Nelson Nash?

- What will you buy in your life?

- What about your need for today’s financing?

- How will you pay for that?

- What is Bank on Yourself®?

- What about living benefits?

- What if you didn’t have to rely on banks?

- What about retirement?

- What about the function of banking?

- What is fractional reserve banking?

- How about an example?

- What is the money multiplier effect?

- Is this magical?

- What are the downsides?

- What happened in 2020?

- What are the reserve requirements now?

- What happened to the reserve?

- What about insolvency and fragility?

- What about the FDIC?

- What percentage of deposits are backed up by FDIC?

- Would you like to hear Episode 299 to learn more about the FDIC?

- What about spending and debt?

- What causes financial stress?

- What is the average American debt?

- Is paying cash the answer?

- What do we do here?

- What about the Bank on Yourself® strategy?

- What about leverage?

- What about private lending?

- Would you like to hear Episode 331?

- So what?

- Are your life insurance policies properly designed and up to date?

- What about an inventory of your own debt?

- Would you like to explore the Bank on Yourself® strategy deeper?

334 episode

Manage episode 396232069 series 1610796

Konten disediakan oleh Not Your Average Financial Podcast™. Semua konten podcast termasuk episode, grafik, dan deskripsi podcast diunggah dan disediakan langsung oleh Not Your Average Financial Podcast™ atau mitra platform podcast mereka. Jika Anda yakin seseorang menggunakan karya berhak cipta Anda tanpa izin, Anda dapat mengikuti proses yang diuraikan di sini https://id.player.fm/legal.

In this episode, we ask:

- Can information alone change your financial future?

- Would you like to check out our FREE Not Your Average Financial Community?

- Have you listened to the previous episodes in this series?

- Would you like to hear Episode 330: No.1 Scaling Up and Overcoming Adversity?

- Would you like to hear Episode 331: No.2 Money Team, Family Finance and Estate Planning?

- Would you like to hear Episode 332: No.3 Liquidity and Cash Flow?

- What is the essential nature of insurance?

- What is the cost of insurance?

- What creates peace of mind?

- What is the purpose of all of this?

- What outcomes would you like?

- What about guarantees?

- What are the different types of insurance policies?

- What about health insurance?

- Who has medical bills?

- Why have health insurance?

- What about the alternative?

- What are the typical costs?

- What about being uninsured?

- What is the leading cause of bankruptcy in the U.S.?

- What is the health insurance marketplace?

- What about healthcare sharing ministries?

- Would you like to hear Episode 170?

- Would you like to hear Episode 224?

- What about property and casualty insurance?

- What is the average claim?

- What could protect you from financial ruin?

- What about auto insurance?

- What about umbrella insurance?

- What is coverage?

- What is a deductible?

- What about self insurance?

- What about life insurance?

- What happens upon death?

- How will your family afford the costs when you’re gone?

- What about cheap term insurance?

- What about group life plans through employers?

- What about getting insurance that meets your needs?

- What does banking have to do with life insurance?

- Who was Nelson Nash?

- What will you buy in your life?

- What about your need for today’s financing?

- How will you pay for that?

- What is Bank on Yourself®?

- What about living benefits?

- What if you didn’t have to rely on banks?

- What about retirement?

- What about the function of banking?

- What is fractional reserve banking?

- How about an example?

- What is the money multiplier effect?

- Is this magical?

- What are the downsides?

- What happened in 2020?

- What are the reserve requirements now?

- What happened to the reserve?

- What about insolvency and fragility?

- What about the FDIC?

- What percentage of deposits are backed up by FDIC?

- Would you like to hear Episode 299 to learn more about the FDIC?

- What about spending and debt?

- What causes financial stress?

- What is the average American debt?

- Is paying cash the answer?

- What do we do here?

- What about the Bank on Yourself® strategy?

- What about leverage?

- What about private lending?

- Would you like to hear Episode 331?

- So what?

- Are your life insurance policies properly designed and up to date?

- What about an inventory of your own debt?

- Would you like to explore the Bank on Yourself® strategy deeper?

334 episode

Semua episode

×Selamat datang di Player FM!

Player FM memindai web untuk mencari podcast berkualitas tinggi untuk Anda nikmati saat ini. Ini adalah aplikasi podcast terbaik dan bekerja untuk Android, iPhone, dan web. Daftar untuk menyinkronkan langganan di seluruh perangkat.