Introducing The Unshakeables, a new podcast from Chase for Business and iHeartMedia's Ruby Studio. Small businesses are the heart and soul of this country, but it takes a brave individual to start and run a company of their own. From mom-and-pop coffee shops to auto-detailing garages -- no matter the type of industry you’re in, every small business owner knows that the journey is full of the unexpected. A single moment may even change the course of your business forever. Those who stand firm ...

…

continue reading

Konten disediakan oleh Not Your Average Financial Podcast™. Semua konten podcast termasuk episode, grafik, dan deskripsi podcast diunggah dan disediakan langsung oleh Not Your Average Financial Podcast™ atau mitra platform podcast mereka. Jika Anda yakin seseorang menggunakan karya berhak cipta Anda tanpa izin, Anda dapat mengikuti proses yang diuraikan di sini https://id.player.fm/legal.

Player FM - Aplikasi Podcast

Offline dengan aplikasi Player FM !

Offline dengan aplikasi Player FM !

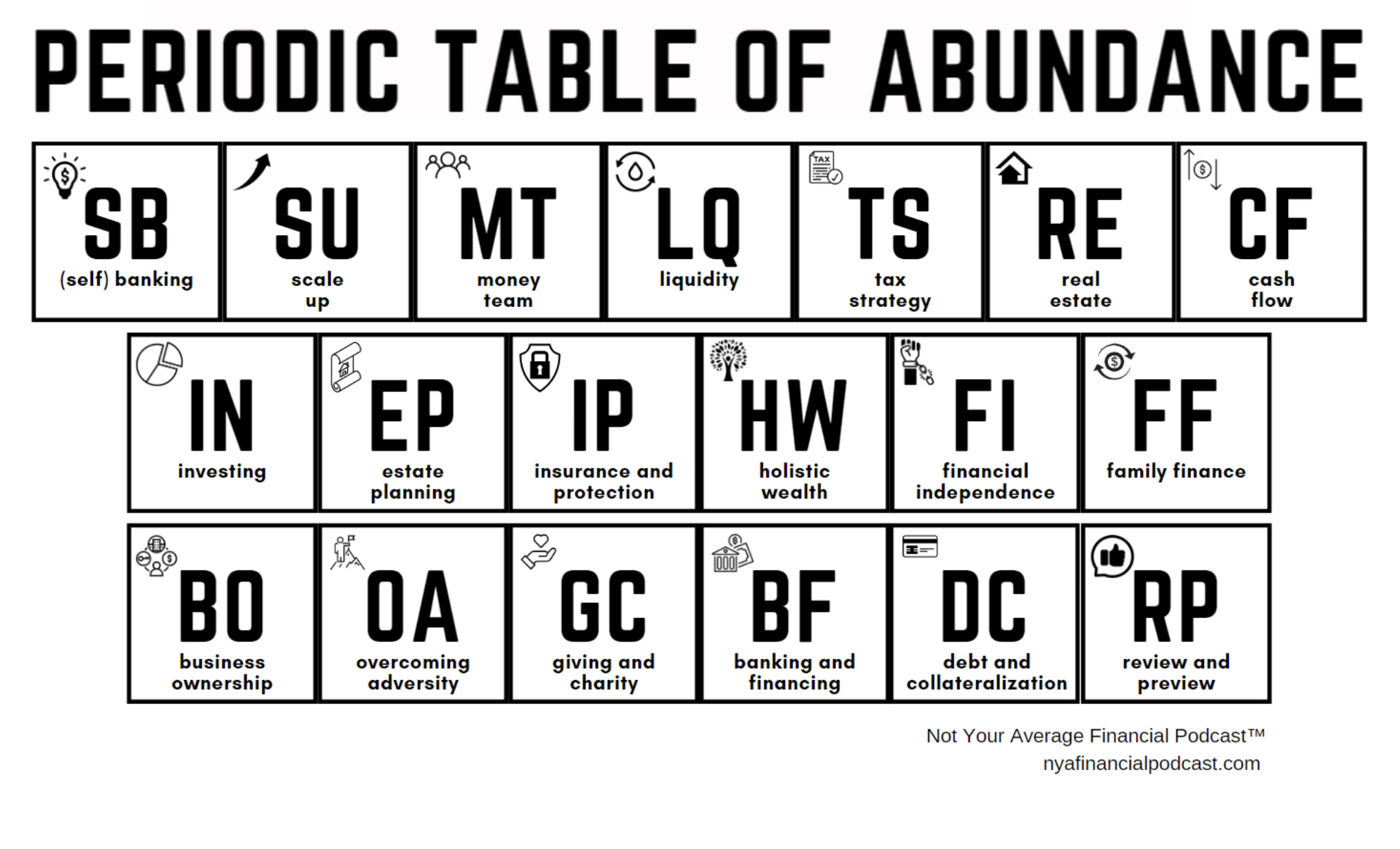

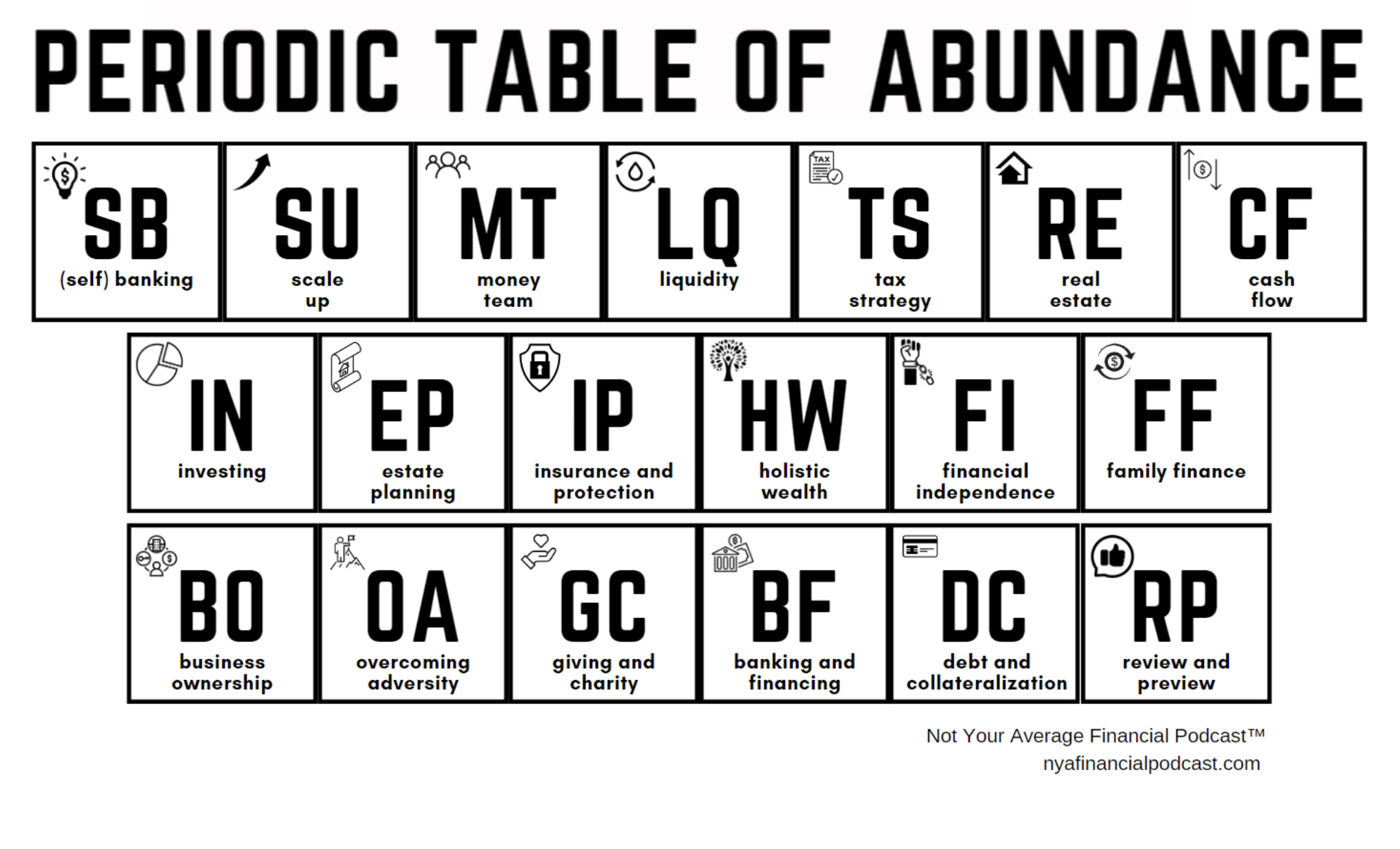

Episode 336: [Periodic Table of Abundance] No.7 Financial Independence and the Magic of Collateralization

Manage episode 400034983 series 1610796

Konten disediakan oleh Not Your Average Financial Podcast™. Semua konten podcast termasuk episode, grafik, dan deskripsi podcast diunggah dan disediakan langsung oleh Not Your Average Financial Podcast™ atau mitra platform podcast mereka. Jika Anda yakin seseorang menggunakan karya berhak cipta Anda tanpa izin, Anda dapat mengikuti proses yang diuraikan di sini https://id.player.fm/legal.

In this episode, we ask:

- Would you like to get the special report on the Periodic Table of Abundance? Would you like to Request a Meeting?

- Have you listened to the previous episodes in this series?

- Would you like to hear Episode 330: No.1 Scaling Up and Overcoming Adversity?

- Would you like to hear Episode 331: No.2 Money Team, Family Finance and Estate Planning?

- Would you like to hear Episode 332: No.3 Liquidity and Cash Flow?

- Would you like to hear Episode 333: No.4 Secrets of Leverage with Insurance and Banking?

- Would you like to hear Episode 334: No.5 Achieve Your Ultimate Potential with Investing and Real Estate

- Would you like to hear Episode 335: No.6 Building a Better World Through Business Ownership, Tax Strategy and Giving

- What is financial independence?

- Would you like to learn about financial independence?

- Would you like to learn about the power of financial collateralization?

- Do you have enough passive income to cover your expenses?

- Do you have to depend on your active income?

- Do you have streams of income to replace your day job?

- What are your expenses?

- What are the stages?

- Do you have an emergency?

- Why did we choose one year for an emergency?

- What about placing your emergency fund in a Bank On Yourself® type whole life insurance policy?

- What about passive income exceeding earned income?

- Would you like to run the financial independence calculator with Mark or a colleague?

- What would it take to cover a luxury item?

- What about changing the world through philanthropy?

- What about the journey?

- What about Odysseus?

- What about freedom?

- What did Nietzsche say?

- What about Frodo?

- What about Iron Man?

- What about Luke?

- What are most financial advisors up to?

- What do you want?

- What are the five mile posts?

- What is basecamp?

- What about reducing your expenses or increasing your income?

- Would you like to hear Episode 19?

- Would you like to hear Episode 63?

- What does Parkinson’s law of finance say?

- What about being honest with money?

- What about investing in yourself?

- What about your education?

- What about your health?

- Are you a better version of yourself?

- Do you have an idea of what you will be doing?

- How do you expect to be in a different place a year from now?

- What is the greatest challenge you’re facing right now?

- What have you tried in the past?

- What are you going to do next?

- …By when?

- What about liquidity?

- What will you do in an emergency?

- Do you budget?

- Do you save in liquid form?

- Who has a financially unstable pyramid?

- Who is putting all of their money at risk?

- Is your money liquid?

- Is your money available to you?

- Who does this benefit?

- Could you cover an emergency expense of $400?

- Do you need to sell your stuff?

- Why not build a stable financial structure?

- What did Tim Austin say about the 10/10/10 rule?

- Who is saving 30% of income each month?

- Now that I’m saving, where do I save it?

- Is your money stashed in the right place?

- What about CDs?

- What is taxable?

- What are you really earning after taxes?

- What about interest rates on (multi-year guaranteed annuities) MYGAs?

- What about Bank on Yourself® type whole life insurance policies?

- What about the power of collateralization?

- What about cash value?

- Would you like to hear Episode 32?

- What about investing in things you understand and control?

- What do you need to quit?

- Do you need a rental property?

- Do you need to borrow against your life insurance policy?

- What can you control?

- What are you into?

- Where can you put your money to work?

- How might you create multiple streams of passive income?

- How might you buy multiple streams of passive income?

- What could you do to add one more stream?

- Can you outspend any income?

- What about mentoring?

- Are you the guide?

- What do you have to share with the world?

- How are you writing your story?

- How many pages do you have left?

- Would you like to like to meet with Mark?

334 episode

Manage episode 400034983 series 1610796

Konten disediakan oleh Not Your Average Financial Podcast™. Semua konten podcast termasuk episode, grafik, dan deskripsi podcast diunggah dan disediakan langsung oleh Not Your Average Financial Podcast™ atau mitra platform podcast mereka. Jika Anda yakin seseorang menggunakan karya berhak cipta Anda tanpa izin, Anda dapat mengikuti proses yang diuraikan di sini https://id.player.fm/legal.

In this episode, we ask:

- Would you like to get the special report on the Periodic Table of Abundance? Would you like to Request a Meeting?

- Have you listened to the previous episodes in this series?

- Would you like to hear Episode 330: No.1 Scaling Up and Overcoming Adversity?

- Would you like to hear Episode 331: No.2 Money Team, Family Finance and Estate Planning?

- Would you like to hear Episode 332: No.3 Liquidity and Cash Flow?

- Would you like to hear Episode 333: No.4 Secrets of Leverage with Insurance and Banking?

- Would you like to hear Episode 334: No.5 Achieve Your Ultimate Potential with Investing and Real Estate

- Would you like to hear Episode 335: No.6 Building a Better World Through Business Ownership, Tax Strategy and Giving

- What is financial independence?

- Would you like to learn about financial independence?

- Would you like to learn about the power of financial collateralization?

- Do you have enough passive income to cover your expenses?

- Do you have to depend on your active income?

- Do you have streams of income to replace your day job?

- What are your expenses?

- What are the stages?

- Do you have an emergency?

- Why did we choose one year for an emergency?

- What about placing your emergency fund in a Bank On Yourself® type whole life insurance policy?

- What about passive income exceeding earned income?

- Would you like to run the financial independence calculator with Mark or a colleague?

- What would it take to cover a luxury item?

- What about changing the world through philanthropy?

- What about the journey?

- What about Odysseus?

- What about freedom?

- What did Nietzsche say?

- What about Frodo?

- What about Iron Man?

- What about Luke?

- What are most financial advisors up to?

- What do you want?

- What are the five mile posts?

- What is basecamp?

- What about reducing your expenses or increasing your income?

- Would you like to hear Episode 19?

- Would you like to hear Episode 63?

- What does Parkinson’s law of finance say?

- What about being honest with money?

- What about investing in yourself?

- What about your education?

- What about your health?

- Are you a better version of yourself?

- Do you have an idea of what you will be doing?

- How do you expect to be in a different place a year from now?

- What is the greatest challenge you’re facing right now?

- What have you tried in the past?

- What are you going to do next?

- …By when?

- What about liquidity?

- What will you do in an emergency?

- Do you budget?

- Do you save in liquid form?

- Who has a financially unstable pyramid?

- Who is putting all of their money at risk?

- Is your money liquid?

- Is your money available to you?

- Who does this benefit?

- Could you cover an emergency expense of $400?

- Do you need to sell your stuff?

- Why not build a stable financial structure?

- What did Tim Austin say about the 10/10/10 rule?

- Who is saving 30% of income each month?

- Now that I’m saving, where do I save it?

- Is your money stashed in the right place?

- What about CDs?

- What is taxable?

- What are you really earning after taxes?

- What about interest rates on (multi-year guaranteed annuities) MYGAs?

- What about Bank on Yourself® type whole life insurance policies?

- What about the power of collateralization?

- What about cash value?

- Would you like to hear Episode 32?

- What about investing in things you understand and control?

- What do you need to quit?

- Do you need a rental property?

- Do you need to borrow against your life insurance policy?

- What can you control?

- What are you into?

- Where can you put your money to work?

- How might you create multiple streams of passive income?

- How might you buy multiple streams of passive income?

- What could you do to add one more stream?

- Can you outspend any income?

- What about mentoring?

- Are you the guide?

- What do you have to share with the world?

- How are you writing your story?

- How many pages do you have left?

- Would you like to like to meet with Mark?

334 episode

Minden epizód

×Selamat datang di Player FM!

Player FM memindai web untuk mencari podcast berkualitas tinggi untuk Anda nikmati saat ini. Ini adalah aplikasi podcast terbaik dan bekerja untuk Android, iPhone, dan web. Daftar untuk menyinkronkan langganan di seluruh perangkat.